Ah, the smell of fresh calendars, new year’s resolutions, and… taxes. As we march into 2025, it’s time to tackle the question everyone dreads: What’s changed this year, and how will it impact me? Or maybe an even better question: Is this the year to finally let a tax specialist handle it all?

But don’t worry – we’re here to make it easy, or as we like to say at TheWiseBook, we’ll simplify the complexity. So, Texas residents, grab your coffee and let’s dive in.

⦁ Standard Deduction Increases (Meaning: More of your money stays with you!)

As you prepare to file your tax return for Tax Year 2024 during Tax Season 2025, here are IRS standard deductions introduced that may affect you. That’s a fancy way of saying you’ll get to deduct more before Uncle Sam takes his share.

For married couples filing jointly, the deduction is now a whopping $29,200 – an increase of $1,500 from last year.

Singles, don’t feel left out; yours is $14,600 (up from $13,850 last year). And if you’re head of household, you’re looking at $21,900 (up from $20,800 last year).

Why this matters: For many of us in Texas, where state taxes aren’t an issue (thank you, Lone Star State!), a higher federal deduction means you keep more of what you’ve worked so hard to earn.

*A Wise Tip: If your income is on the higher side, consider working with a tax pro to maximize your deductions beyond the standard.

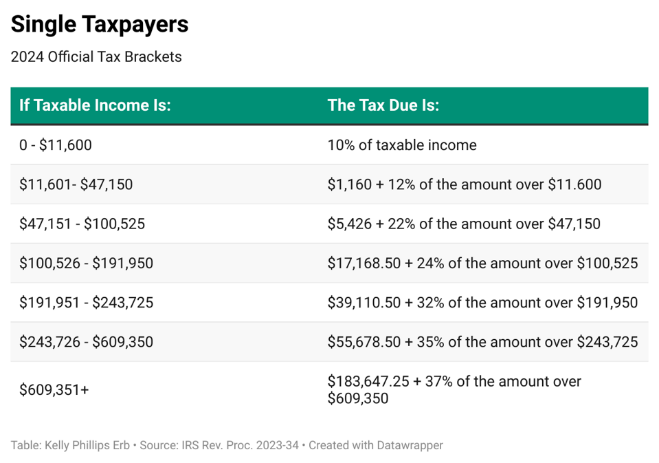

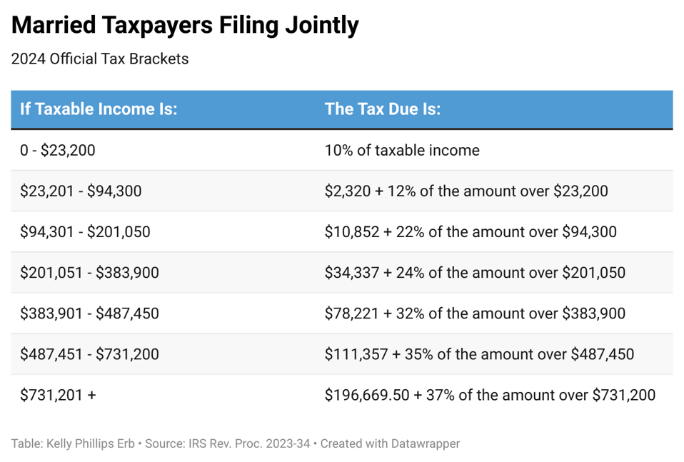

⦁ Tax Brackets Shift Slightly ~ So you’re less likely to cry at filing time

Good news: tax brackets applying to taxable income are adjusting for inflation. This means IRS is giving you a little more breathing room before bumping you into a higher tax bracket.

Why this matters: If your income increased in 2024, you might still stay in the same bracket! But high earners in Texas could consider strategies like retirement contributions to avoid unnecessary taxes.

* A Wise Tip: Keep going to #3. Let’s wait you there.

⦁ Retirement Contribution Limits Are Up (Save for the future and dodge taxes now)

Good news for those with 401(k)s and IRAs: you can sock away even more. Contribution limits have increased to $23,000 for 401(k)s (or $30,500 if you’re 50 or older, thanks to the catch-up contribution). For IRAs, the contribution limit is $7,000 (or $8,500 if you’re 50 or older).

For Tax Year 2024, you have until April 15, 2025 to make contributions to a traditional IRA. This extended deadline gives you an opportunity to maximize your retirement savings and potentially reduce your tax bill if you haven’t contributed during the year.

What your right questions: Lower taxable income? Deadlines of Last-Minute Contributions for IRA or HSA? For more details, please visit <here>

*A Wise Tip: Not sure where to start? Sign us up. We’ll help you maximize these accounts while keeping you on track for retirement goals or financial freedom.

⦁ Expanded Clean Energy Credits (Go green, save green!)

Thinking about installing solar panels or driving a shiny new EV in 2025? The IRS has you covered with expanded clean energy tax credits. You could qualify for a 30% credit for solar installations and up to $7,500 for EV purchases – depending on your income and the car’s price.

Why this matters: For Texas residents who care about both their carbon footprint and their wallet, these credits are a win-win.

* A Wise Tip: Plan those upgrades early since credits often require paperwork. You can claim the credit when purchasing qualified vehicles or when filing your tax return. There are also income limits to consider – contact us to learn more.

⦁ Child Tax Credit Returns to Pre-Pandemic Levels

Parents, it’s bittersweet: the expanded child tax credit is back to its 2019 glory days. For most families, that means $2,000 per eligible child under 17.

Why this matters: If you’ve been relying on the higher credit amounts from recent years, this adjustment might impact your refund. Let’s plan ahead.

*A Wise Tip: We’re here for help calculating how this affects your family’s tax picture? Only 1 call away.

⦁ Sneaky Tax Law Adjustments You Can’t Ignore

Let’s not sugarcoat it: the IRS loves fine print. A few other notable changes to watch out for:

1099-K Thresholds Stay Put: Selling goods online? The $5,000 threshold applies to income received through third-party payment platforms like Venmo, PayPal, and others (income-generating transactions only, such as sales or freelance payments). Yes, even for that garage sale cash.

HSA Limits Are Higher: Health savings accounts now allow contributions of $4,150 for individuals and $8,300 for families. Tax-free medical savings, anyone?

Why Choose TheWiseBook for Tax Season 2025?

Frankly, taxes are confusing, but they don’t have to be.

At TheWiseBook, we’re pros at untangling the mess, finding hidden deductions, and ensuring you’re in the best position possible.

Plus, we promise while we’re serious about getting you the best results, we’ll keep things easy to understand – maybe with a smile or two along the way.

Let’s Simplify Your Taxes Today!

Located right here in Cypress, we understand the unique needs of our community, including high-income professionals and families navigating the U.S. tax system. Whether it’s your personal taxes, business books, or preparing for a financial review, we’ve got your back.

Ready to tackle 2025 without the stress?